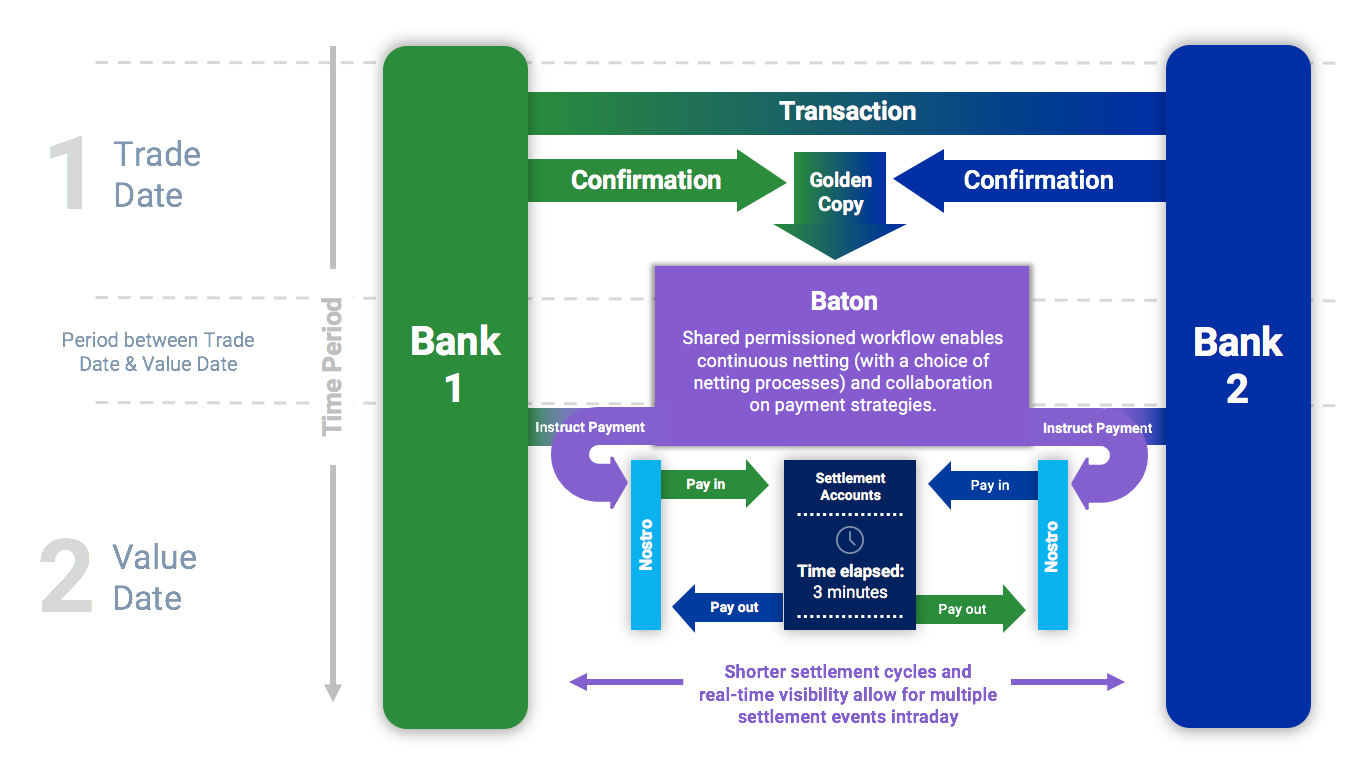

Baton Systems is transforming the settlement of transactions across the world’s largest financial markets. They’re distributed ledger platform increases the visibility across payments for Cash Management & Treasury Operations and FX.

In these new publications Baton highlights the multiple inefficiencies in the market today and discusses the need for a new approach to the movement of assets – and how the Baton platform delivers this.

Baton’s pitch is: solve an old money problem with new market technology.

Baton’s industry proven 90-day methodology which enables firms to assess the ROI of the platform. They do this by benchmarking performance against your firm’s own historical data.

Within 90 days, Baton’s approach allows them to establish:

- A model of the client’s current payment flows using the Baton process – enabling them to measure the impact on capital, funding, settlement risk and settlement costs

- The benefits the client can achieve by deploying the Baton platform

- A phased implementation roadmap, detailing each milestone for delivery beyond the pilot – along with the bene ts of each milestone

- A medium and long-term roadmap of how legacy technology and processes can be decommissioned or moved over to Baton – enabling the client to save on legacy costs and manual processes

- The total cost of implementation (depending on the levels of integration)

Baton was founded in 2016 by technology, payments and capital markets veterans, and backed by venture capital. They are working with numerous market participants – including major global banks, custodian banks and exchanges – to meet today’s demands for capital efficiency, regulatory compliance and operational superiority.

Using the Baton platform firms are able to:

- Complete on-demand settlement processes in three minutes or less – removing uncertainty over when payments will be received

- Eliminate settlement risk

- Deliver a 25% reduction in settlement costs

- Agree settlement values gross or net (using threshold or time-based netting strategies)

- Collaborate on a range of payment strategies (including split, linked and conditional payments)

- Eliminate the need to pre-fund hours before receipt

- Implement split payments using a shared work ow, easing liquidity blockages

Download Baton’s latest industry article: